There’s Still Time to Claim the Employee Retention Tax Credit

Content

Our unbiased reviews and content are Adp Tax Credit Guideed in part by affiliate partnerships, and we adhere to strict guidelines to preserve editorial integrity. The editorial content on this page is not provided by any of the companies mentioned and has not been reviewed, approved or otherwise endorsed by any of these entities. If you’re interested in more tax savings, check out these small business tax deductions. For an employee’s wages to count towards the Work Opportunity Tax Credit, he or she will need to work at least 120 hours. If they work between 120 and 400 hours, you can claim 25% of their allowable wages. If they work at least 400 hours, you are allowed to claim 40% of allowable wages.

- Corporations that are related under common control are treated as a single entity for purposes of the CARES Act employee retention credit.

- The worksheet is not required by the IRS to be attached to Form 941.

- The primary way ADP helps with the ERTC is by posting informative articles.

- ADP doesn’t publish details on how much it charges for posting ERTC requests, but if an accountant referred you to their site, you can almost guarantee that the commission paid to the accountant will be added to your cost.

Taken together, this study aims to employ the ADP as a policy experiment to examine the impacts of tax incentives on CSR performance, contributing to the above two bodies of literature. For employers with more than 100 full-time employees, qualified wages are wages paid to employees when they are not providing services due to COVID-19-related circumstances. Most employers, including colleges, universities, hospitals and 501 organizations following the enactment of the American Rescue Plan Act, could qualify for the credit. However, the IRS makes it clear that expenses eligible for PPP forgiveness that were not included in the loan forgiveness application cannot be factored in after the fact. Employers who qualify, including PPP recipients, can claim a credit against 70% of qualified wages paid. Additionally, the amount of wages that qualifies for the credit is now $10,000 per employee per quarter.

Tax Credit Strategy Guide

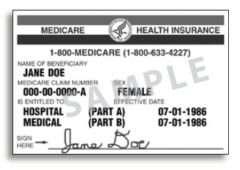

Conditions and exceptions https://adprun.net/ – see your Cardholder Agreement for details about reporting lost or stolen cards and liability for unauthorized transactions. For tax years beginning after 2017, applicants claimed as dependents must also prove U.S. residency unless the applicant is a dependent of U.S. military personnel stationed overseas. A passport that doesn’t have a date of entry won’t be accepted as a stand-alone identification document for dependents.

There are two different methods to correct ADP and ACP mistakes beyond the 12-month period. Both require the employer to make a qualified nonelective contribution to the plan for NHCEs. A qualified nonelective employer contribution is an employer contribution that is always 100% vested and subject to the same distribution restrictions as elective deferrals. The tax doesn’t apply if the plan sponsor makes corrective qualified nonelective contributions within 12 months after the end of the plan year if the plan uses current year testing. However, if the corrective contributions are insufficient for the CODA to pass the ADP test, the tax applies to the remaining excess contributions.

How do I apply for the WOTC credit?

Get ahead of your independent contractor tax obligations and check out our Filing Guide to Gig Worker Taxes. You’ll need to file a Schedule C to report the income and any expenses related to that income. Refund Advance A 0% interest loan of up to $3,500 received within minutes of filing, if approved.

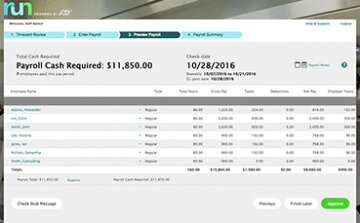

The ERTC ADP articles can be very useful to business owners who have questions about the ERTC. ADP also offers resources for accountants or similar professionals. The company also says it will provide accountants with a commission if they refer clients who want the ERTC to ADP. The deadlines range from April 31, 2023, to January 31, 2025.