candlesticks for dummies: Candlestick Charting For Dummies, 2nd Edition

Contents:

I am a lot more https://g-markets.net/able after making it through this book from beginning to end despite them because I was able to build on the understanding of the candlesticks that I already had. Highly recommend “Japanese Candlestick Charting Techniques” Second Edition by Steve Nison. Candlestick charting methods have been around for hundreds of years, but candlesticks have caught on over the past decade or so as a charting standard in the United States. I think you’ll feel the same way, and this book is the first step on the path to conquering candlesticks.

Candlestick Charting For Dummies is here to show you that candlestick charts are not just for Wall Street traders. Everyday investors like you can make sense of all those little lines and boxes, with just a little friendly Dummies training. We’ll show you where to find these charts , what they mean, and how to dig out valuable information. Then, you’ll be ready to buy and sell with newfound stock market savvy. We’ll show you where to find these charts , what they mean, and how to dig out valuable information. Then, you’ll be ready to buy and sell with newfound stock market savvy.

1 author pickedTrading Price Action Trendsas one of their favorite books, and they sharewhy you should read it. 1 author pickedThe Little Book of Valuationas one of their favorite books, and they sharewhy you should read it. 1 author pickedBerkshire Hathaway Letters to Shareholdersas one of their favorite books, and they sharewhy you should read it.

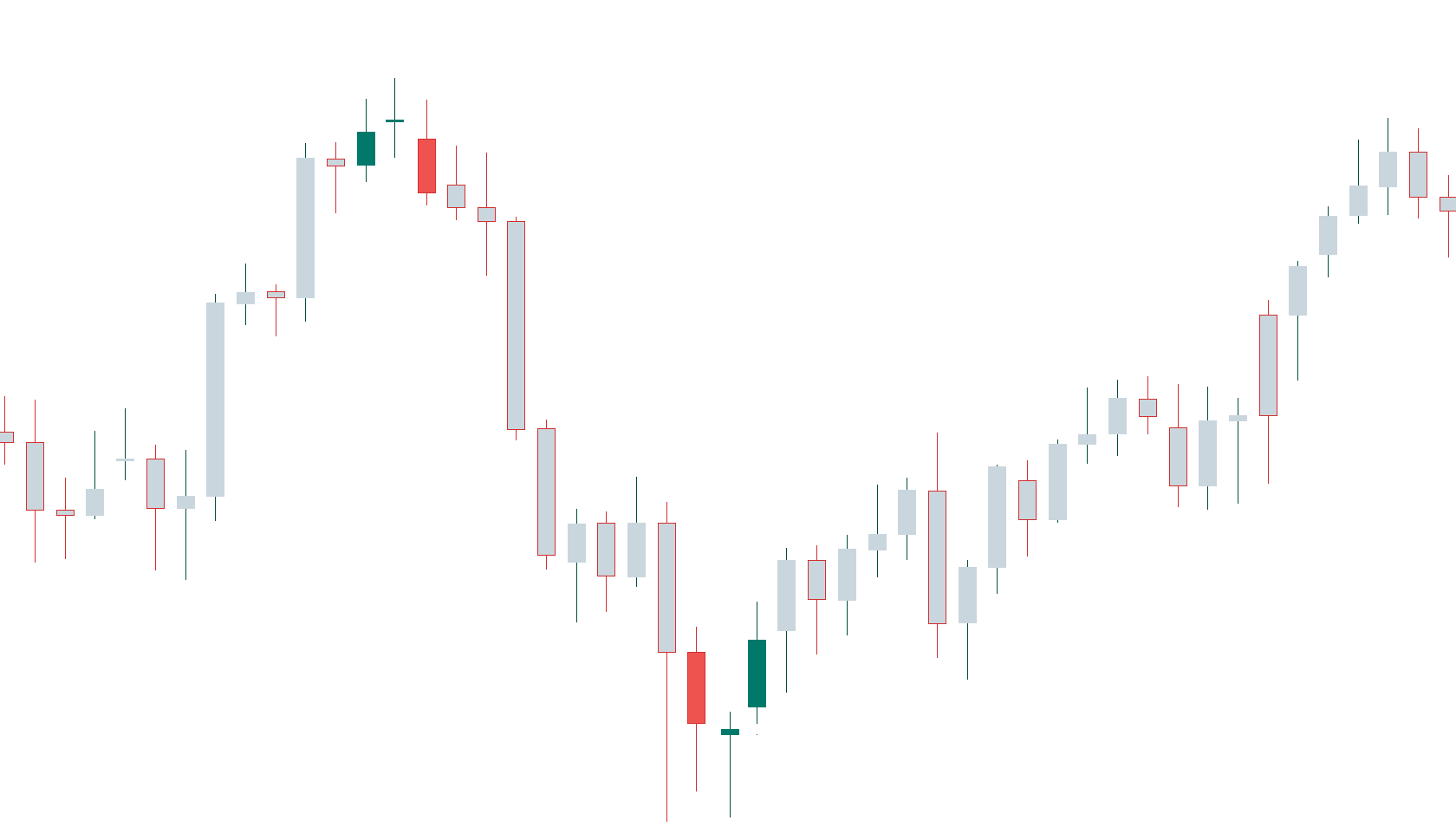

Many algorithms are based on the same price information shown in candlestick charts. Candlesticks show that emotion by visually representing the size of price moves with different colors. Traders use the candlesticks to make trading decisions based on regularly occurring patterns that help forecast the short-term direction of the price. Al Brooks is the most influential author on the pure study of price action. His trilogy is the bible for understanding the messages conveyed by individual candlesticks and price behavior as a whole. A harami cross is a candlestick pattern that consists of a large candlestick followed by a doji.

Candlestick Charting For Dummies (

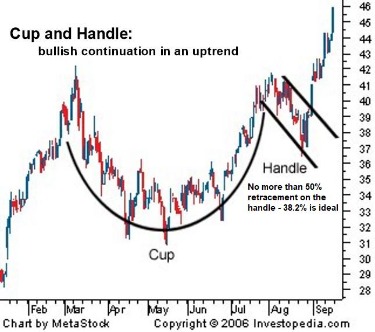

When a candlestick pattern includes three periods’ worth of price action , I consider it a complex pattern. Many complex candlestick patterns require specific price activity over the course of three days for the pattern to be considered valid, and I discuss a range of them in Chapters 9 and 10. Bullet Also, even after reading up on the most rudimentary of candlestick basics, you can easily spot the opening and closing price for a security on a candlestick chart. These price levels can be very important areas of support and resistance from day to day, and knowing where they are can be extremely helpful, especially for short-term traders. With advancements in technology and the growing availability of trading and investing resources available to traders, many options exist for the charting of securities. There are several different types of charts and dozens of variations and features to be configured on each type.

During the next three years, Lewis rose from callow trainee to bond salesman, raking in millions for the firm and cashing in on a modern-day gold rush. Liar’s Poker is the culmination of those heady, frenzied years-a behind-the-scenes look at a unique and turbulent time in American business. From the frat-boy camaraderie of the forty-first-floor trading room to the killer instinct that made ambitious young men gamble everything on a high-stakes game…show more. This icon flags places where I get really technical about charting.

Don’t know whether to grab the bull by the horns or just grin and bear it? Understand how day trading works—and get an action plan Due to the fluctuating economy, trade wars, and new tax laws, the risks and opportunities … 1 author pickedThe Great Waveas one of their favorite books, and they sharewhy you should read it. 1 author pickedTrades about to Happenas one of their favorite books, and they sharewhy you should read it. In his book, David Weis explains the principles of the Wyckoff method from a more modern approach, adapted to today’s markets. 1 author pickedIrrational Exuberanceas one of their favorite books, and they sharewhy you should read it.

The above chart shows the same exchange-traded fund over the same time period. The lower chart uses colored bars, while the upper uses colored candlesticks. Some traders prefer to see the thickness of the real bodies, while others prefer the clean look of bar charts. You may have noticed that hardly anyone uses simple lines on a chart anymore—everyone uses candlesticks. When I was revising my own book, the technical advisor recommended just deleting the part about different types of standard bars and presenting only candlesticks.

Part 1: Getting Familiar With Candlestick Charting And Technical Analysis

The possibilities for candlestick charts are many and varied, and I do my best to touch on a wide range of their uses and benefits. I explore several different types of technical indicators in Chapter 11 and clue you in on a few ways that you can combine these indicators with candlestick patterns in Part IV . Find a few technical indicators that match up to the type of trading you want to pursue and add them to your candlestick charts.

And the candlestick with the white candle indicates that there was more buying pressure than desire to sell. You can’t have a For Dummies book without a Part of Tens, and this book is certainly no exception. When you come across the Technical Stuff icon, you may skip ahead because this icon indicates information that’s additive to trading knowledge, but not essential to gaining knowledge about candlestick charting. I hope that the candlestick methods described in this book help readers to make trading and investment decisions that lead to solid profits, but unfortunately, there’s no guaranteeing that. What I can guarantee is that after reading this book , you can gain a useful understanding of what candlesticks are, what they represent, and how they can be used in trading.

The pattern completes when the fifth day makes another large downward move. It shows that sellers are back in control and that the price could head lower. A short upper shadow on an up day dictates that the close was near the high.

This is the Dummies guide for beginner and intermediate investors who want to make smarter decisions with a better understanding of how to read candlestick charts. I don’t know of any traders or investors who’ve taken the time to fully understand candlestick charting and then not used the techniques in their trades. After you’ve taken the time to grasp candlestick basics, it’s tough to deny their advantages over other types of charts, and the profits can certainly speak for themselves.

book lists we think you will like!

Sidebars contain nonessential material, and you can tell them apart from the rest of the text because they’re placed in gray shaded boxes. Bullet Italics are used for emphasis and to highlight new words that are presented with easy-to-understand definitions. Now, for the first time ever, the time-tested, proven techniques perfected by the world-famous Dale Carnegie® sales training program are available in book form. Get Mark Richards’s Software Architecture Patterns ebook to better understand how to design components—and how they should interact. Try not to anticipate that a pattern is going to be created by trading before the formation is complete. Determine whether the market is trending up, trending down, or not trending at all.

- A bearish harami is a small real body completely inside the previous day’s real body.

- Learning charting takes some time, and this book is a great start.

- It covers the latest investing technology, cryptocurrency, and today’s somewhat-less-predictable market environment.

- Al Brooks is the most influential author on the pure study of price action.

For orders shipped to non-candlesticks for dummies, the customer must bear the return shipping costs. Even though the pattern shows us that the price is falling for three straight days, a new low is not seen, and the bull traders prepare for the next move up. Warren Buffett is public and candid about his investment choices.

Getting into securities trading is now easier than it ever has been, and the result is a whole generation of investors and traders that handle their finances without professional help. Technology allows these people to enjoy many new types of market information, and one of the best tools available is candlestick charting. I begin Part IV with Chapter 11, which offers a more in-depth discussion of several other technical indicators. It’s useful for any trader to understand a variety of indicators because you can use them alone, to confirm your candlestick signals, and in combination with candlestick patterns.

Free Media Mail shipping on U.S. orders over $50

The simplest candlestick patterns involve just one day or one period of price data, and you can find information on those patterns in Chapters 5 and 6. Bullet One of the best features of candlestick charting in general is the visual appeal and readability. You can glance at a candlestick chart and quickly gain an understanding of what’s going on with the price of a security. You can also tell whether sellers or buyers have dominated a given day, and get a sense of how the price is trending.

- This is not so much a pattern to act on, but it could be one to watch.

- These charts are a few of the most common and reliable bullish two-day trend reversal patterns in an uptrend.

- Technology allows these people to enjoy many new types of market information, and one of the best tools available is candlestick charting.

- Mutual Funds for Dummies Position your portfolio for growth with one of America’s bestselling mutual fund books.

- Get Mark Richards’s Software Architecture Patterns ebook to better understand how to design components—and how they should interact.

And knowing what may lie ahead can be the difference between a profitable trade and a flop. Although candlestick patterns alone have proven to be reliable trading tools, using them in combination with other indicators can greatly enhance their ability to predict the future direction of a market or a stock. In the rest of Part IV, I take some simple and complex patterns and combine them with pure technical indicators to show you how coupling the two techniques can lead to profitable trading. The chapters in this part are chock-full of fascinating real-world examples from a variety of markets and industries. Two-stick candlestick patterns are one step up from those basic patterns, but just a single step up in complexity can provide quite a bit of additional information and versatility.

Search books by title, author, or ISBN

Even after 15 years of trading experience, I still tend to paper trade new ideas or systems for a while before putting real money to work. Here are two common examples of bearish three-day trend reversal patterns. The bullish harami is the opposite of the upside down bearish harami. A downtrend is in play, and a small real body occurs inside the large real body of the previous day. If it is followed by another up day, more upside could be forthcoming. A bearish engulfing pattern develops in an uptrend when sellers outnumber buyers.

Candlestick charts also feature specific patterns that you can identify and use to decide when it’s time to buy, sell, or wait on a trade or investment. These patterns can be a real boon to your work with securities, and you can combine them with other technical indicators for even more reliable results. Three-stick patterns are the most complex patterns that I deal with in this book, and their nuts and bolts are explained in this part.