Standard Costs and Variance Analysis Principles of Managerial Accounting

Excessive inventories, particularly those that are still in process, are considered evil as they generally cause additional storage cost, high defect rates and spoil workers’ efficiency. Due to these reasons, managers need to be cautious in using this variance, particularly when the workers’ team is fixed in short run. In such situations, a better idea may be to dispense with direct labor efficiency variance – at least for the sake of workers’ motivation at factory floor. Labor efficiency variance happens when the price per direct labor remains the same but the time spends to produce one unit different from standard costing. Management makes the wrong estimate of the time spent in production or the actual time increase due to various reasons. When the actual time spends different from the estimation, it will lead to a difference of the actual cost and the standard cost.

Variable manufacturing overhead rate variance

It can be both favorable (actual cost less than the estimate) or unfavorable, the actual is higher than estimate. At the beginning of the period, Brad projected that the standard cost to produce one unit should be $7.35. Per the standard, total variable production costs should have been $1,102,500 (150,000 units x $7.35). However, Brad actually incurred $1,284,000 in variable manufacturing costs. Actual variable manufacturing costs incurred were $181,500 over the budgeted or standard amount. The example of the NoTuggins dog harness is used throughout this chapter to illustrate standard costs and standard costs variances for product costs.

Video Illustration 8-2: Computing direct materials variances

This direct materials price variance could indicate a purchasing issue, such as the purchasing department paying more than the agreed-upon amount (purchase order amount). Or the cause could be a supplier or sourcing issue in which the material can be sourced cheaper elsewhere. Another possibility is that the direct material price standard needs to be increased because prices have increased. The completed top section of the template contains all the numbers needed to compute the direct materials quantity and price variances. The direct materials quantity and price variances are used to determine if the overall variance is a quantity issue, price issue, or both.

Would you prefer to work with a financial professional remotely or in-person?

For example, rent expense for the production factory is the same every month regardless of how many units are produced in the factory. Within the relevant range of production, fixed costs do not have a quantity standard, only a price standard. Fixed manufacturing overhead is analyzed by comparing the standard amount allowed to the actual amount incurred. Even though the answer is a negative number, the variance is favorable because employees worked more efficiently, saving the organization money.

- In this case, the actual hours worked per box are \(0.20\), the standard hours per box are \(0.10\), and the standard rate per hour is \(\$8.00\).

- However, after the first round of products is completed, records indicate that 65 labor hours were used, to complete the item in question.

- Each unit requires 0.25 direct labor hours at an average rate of $18 per hour for a total direct labor cost of $4.50 per unit.

- Management has requested standard cost variances in order to isolate the issue.

Fundamentals of Direct Labor Variances

The standard hours are the expected number of hours used at the actual production output. If there is no difference between the actual hours worked and the standard hours, the outcome will be zero, and no variance exists. In this case, the actual rate per hour is \(\$7.50\), the standard rate per hour is \(\$8.00\), and the actual hour worked is \(0.10\) hours per box. This shows that our freelance invoice template labor costs are over budget, but that our employees are working faster than we expected. United Airlines asked abankruptcy court to allow a one-time 4 percent pay cut for pilots,flight attendants, mechanics, flight controllers, and ticketagents. The pay cut was proposed to last as long as the companyremained in bankruptcy and was expected to provide savings ofapproximately $620,000,000.

5: Direct Labor Variance Analysis

It indicates decreased efficiency, where the actual hours surpass the anticipated ones, potentially leading to higher labor costs and inefficiencies within the production process. Recall from Figure 10.1 that the standard rate for Jerry’s is$13 per direct labor hour and the standard direct labor hours is0.10 per unit. Figure 10.6 shows how to calculate the labor rateand efficiency variances given the actual results and standardsinformation.

Since this measures the performance of workers, it may be caused by worker deficiencies or by poor production methods. Labor mix variance is the difference between the actual mix of labor and standard mix, caused by hiring or training costs. Figure 10.7 contains some possible explanations for the laborrate variance (left panel) and labor efficiency variance (rightpanel).

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

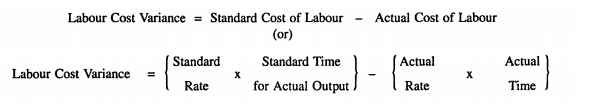

What we have done is to isolate the cost savings from our employees working swiftly from the effects of paying them more or less than expected. Labor rate variance arises when labor is paid at a rate that differs from the standard wage rate. Labor efficiency variance arises when the actual hours worked vary from standard, resulting in a higher or lower standard time recorded for a given output. This determination may stem from meticulous time and motion studies or negotiations with the employees’ union. The LEV arises when employees utilize more or fewer direct labor hours than the set standard to finalize a product or conclude a process.

The same calculation is shown as follows using the outcomes of the direct labor rate and time variances. In this case, the actual rate per hour is $7.50, the standard rate per hour is $8.00, and the actual hour worked is 0.10 hours per box. This is a favorable outcome because the actual rate of pay was less than the standard rate of pay. As a result of this favorable outcome information, the company may consider continuing operations as they exist, or could change future budget projections to reflect higher profit margins, among other things. Connie’s Candy paid \(\$1.50\) per hour more for labor than expected and used \(0.10\) hours more than expected to make one box of candy. With either of these formulas, the actual rate per hour refers to the actual rate of pay for workers to create one unit of product.