Sales account planning: a step-by-step guide

In my experience, one of the greatest risks for a successful sale is the emergence of unexpected problems during the due diligence. Buyers want to minimise risks, and any sign of a lack of transparency or incomplete information can make them withdraw or try to renegotiate the purchase price. If you identify possible issues in advance, you will be able to solve them before the buyer discovers them, which generates trust and increases the likelihood of a successful agreement. The historical analysis can help to determine the future trend as well. These studies are usually performed by higher management, the board of directors, and leaders of the company who run it. Record keeping also keeps all the transactions segregated for a business.

A+ Content

Transparency is also helpful in calculating the profit of the organization for a particular period. Do we recognize sale when the goods are dispatched to customers, when the customer receives those goods, or when we receive the payment in respect of those goods? In case of sale of goods, sale is generally said to occur when the seller transfers the risks and rewards pertaining to the asset sold to the buyer. The receipt of payment from the customer is not relevant to the recognition of sale since income is recorded under the accruals basis.

Drive online sales for your products

Sulzberger’s son-in-law Arthur Ochs became publisher in 1963, adapting to a changing newspaper industry and introducing radical changes. Supreme Court case New York Times Co. v. Sullivan, which restricted the ability of public officials to sue the media for defamation. At Confianz, our aim is to best bookkeeping boston, ma 2023 assist clients through every stage of the sale process, from the initial valuation to the due diligence and final negotiation. We work hand-in-hand with businesses to maximise the value of each transaction and ensure that everything is up to scratch so that they can generate trust in buyers.

Sales Account

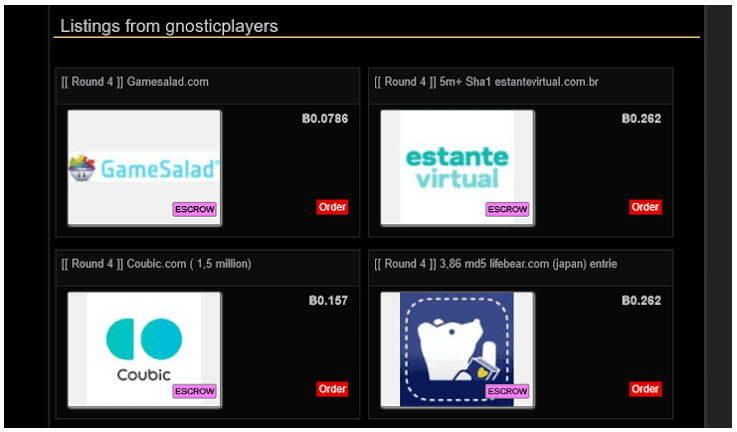

- The one limited exception is that a lawyer may deposit funds “reasonably sufficient” to cover the fees or charges imposed by the depository bank holding the escrow funds.

- Basically, sales account plans help position you as not just a salesperson, but a trusted business partner who can work with the customer to help improve their business, together.

- When selling accounts, another popular type of account is smurf accounts.

- Following the Panic of 1893, Chattanooga Times publisher Adolph Ochs gained a controlling interest in the company.

- If you want to understand how to sell steam games, then start figuring out what is your Steam account value.

The reason is that most lawyers are in substantial compliance with the rules. The minor infractions discovered as a result of such investigations typically result in a warning or low-level private discipline. Sadly, as the investigations following bounced check reports demonstrate, too many experienced lawyers are still unfamiliar with the rules on escrow accounts and record-keeping. Although most lawyers are scrupulously careful about their escrow accounts and the funds entrusted to them, a surprising number of lawyers are still unfamiliar with or careless about the very basic but detailed rules governing escrow accounts.

Step 1: Decide which of your accounts need plans.

It’s important to have a fully loaded arsenal of effective tools to help you win as many deals as possible—account planning is one of those tools. An account plan strategizes your sales by outlining exactly how you’re going to win or retain an account, giving you a blueprint to work with from the get-go. In this article, we’ll go over why you should be using account plans as part of your sales process, how to put one together and finally, how to put it to work for each key account.

Explore selling on Amazon around the world

While lawyers who are not holding client or third-party funds are not required to maintain trust accounts, it is often less bother to have an established and permanent account than to open and close accounts as you need them. Sometimes called an omnibus account, this is a single escrow account, with subaccounts for each client or each matter. The sub-accounts earn interest, which the bank reports on separate 1099 interest statements issued to the named beneficiary of the sub-account, rather than to the law firm. This avoids the problem of imputing significant amounts of interest to the firm when the firm is not actually receiving the interest. The monthly statements include separate listings for each sub-account, which facilitates the firm’s required record-keeping for funds it is holding. All deposits and withdrawals are made into and from the main account, with internal transfers to and from the sub-accounts.

The second cardinal rule is that lawyers may not deposit their own personal or business funds in their escrow or trust accounts. The one limited exception is that a lawyer may deposit funds “reasonably sufficient” to cover the fees or charges imposed by the depository bank holding the escrow funds. [DR 9-102(b) (3), 22 NYCRR §1200.46(b) (3).] A lawyer who uses his escrow account for the deposit of his personal funds faces serious disciplinary sanctions. This is true even if the lawyer does not misuse any of the trust funds in the commingled account.

This means that if sellers want to sell their accounts at a higher price, the best way to do so would be to increase its value based on the previously mentioned criteria rather than simply raising its price. When selling accounts, another popular type of account is smurf accounts. These are used by players that are already in the endgame or have high rankings, but would like to play with lower-level players. While they can make their own accounts, smurf accounts have certain qualities that they are looking for and can’t be found from a freshly made starter account. The main reason that gamers decide to sell game accounts is to make money.

Sales Book – It is a subsidiary book of accounting used to record all goods sold on credit. One of the major differences between sales book and sales account is that only the items sold on credit are recorded in the sales book, whereas the same is not applicable to a sales account as it takes into account both cash and credit sales. Sale revenue is an increase in equity during an accounting period except for such increases caused by the contributions from owners (equity participants). Sale revenue must result in increase in net assets (equity) of the entity such as by inflow of cash or other assets. However, net assets of an entity may increase simply by further capital investment by its owners even though such increase in net assets cannot be regarded as sale revenue.

Besides, finding something that’s not too low (that you get shortchanged), and not too high (that you’d have a hard time selling) is a wise move. To understand this, it is essential to have a sales account of the organization. This is also true in case of acquisitions and mergers in which both of the companies involved in the transaction are required to present the historical data for the basis of comparison. From an accounting standpoint, sales do not occur until the product is delivered.

In such cases, whenever asked, the company should be able to produce the details of the transaction. Account sales is a simple statement which consignees prepare to communicate to the consignors their consignment related financial transactions and activities. Also, there is no specific or standard format available for the preparation of account sales. However, the consignor may guide consignee regarding the order in which the information may be arranged in the account sales. The best format is one which fully satisfy the information needs of the consignor. (Learn how to deliver a killer one here.) This is where you’ll present your sales account plan—namely the action items you have in mind for them.